Global Supply Chain Struggles: Impact on the Fire Service

Introduction

The international global supply chain has taken a strong hit from the COVID 19 pandemic and appears to be undergoing what may be termed “The Long Covid Syndrome.” Following is a summary of how this supply chain syndrome is affecting you and the entire fire service.

Contents

What is a Supply Chain?

A supply chain includes “the entire process of making and selling commercial goods, including every stage from the supply of materials and the manufacture of the goods through to their distribution and sale.”1 It consists of many elements –from manufacturing sites and warehouses to transportation, inventory management, and order fulfillments. (“What is supply chain? A definitive guide.”)

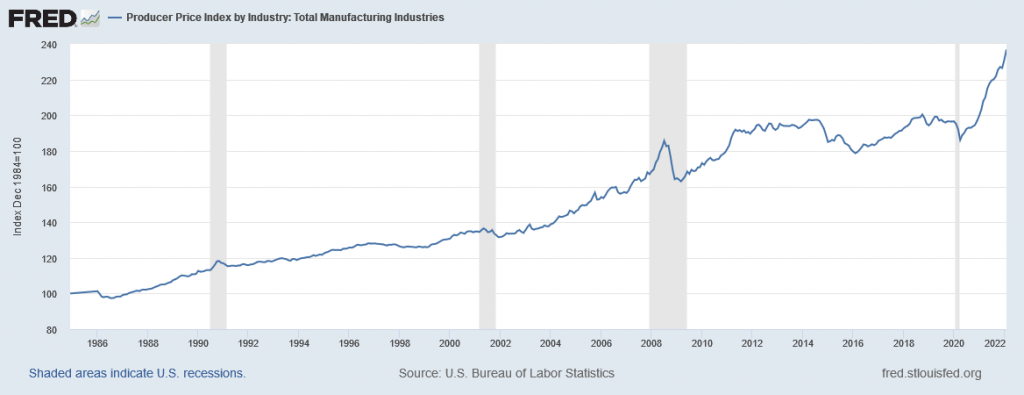

Figure 1. Producer Price Index by Industry: Total Manufacturing Industries

This graph shows the massive escalation of costs/inflation and demand for all manufacturers over the past 12 months. Source: https://fred.stlouisfed.org/series/PCUOMFGOMFG/.

Effects on Product Availability and Cost

The COVID pandemic worsened any weaknesses that already existed in the supply chain. The lockdowns in workplaces and the time lost because of illness–and, in some cases, deaths–among workers have led to a scarcity of labor and significant worldwide shortages of components and materials. Also, skyrocketing freight costs, delayed shipments, and the sharply rising cost of oil have led to higher costs for practically all categories of commodities.

Overall, consumers have been seeing increasing costs in practically every category of goods–in the dairy and meat departments in their grocery stores and at the gas pump, for example. Fire apparatus manufacturers and suppliers are seeing rising costs in valves, fittings, and other apparatus components.

Overtaxed Ports

Overtaxed ports are compounding the challenges: The supply is there, but the ships docked offshore cannot be offloaded. The recovery back to pre-COVID levels will likely extend well into 2022 in the United States, given the demand for labor, driven by the demand for goods and loss of workforce availability.5

Labor

Keeping output up has been a big challenge for fire industry manufacturers. Some companies report having lost almost a third of its direct labor workforce since the start of 2020 and have initiated additional incentives and increased wages to stabilize and increase their workforce. This has forced lead time to be longer on specialty, non-core, and off-line items that necessitate more resources to manufacture.

Not every employee is capable of doing complex welds, explained another FAMA member manufacturer. He notes that the workforce has been reduced by illness (including COVID and the flu), vacations, and mental health issues.

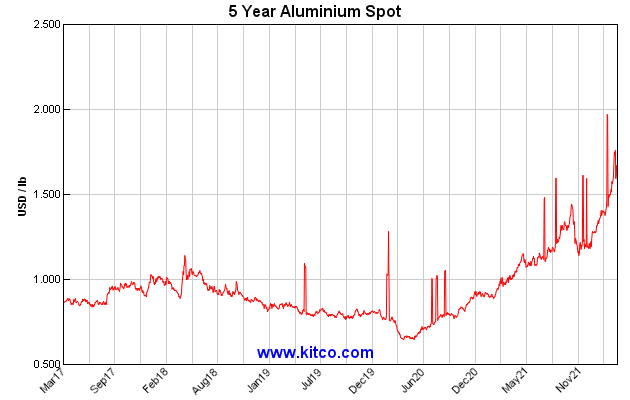

The uncertainty surrounding the availability and pricing of products in this “new normal” marketplace poses significant stress for manufacturers and consumers. Fire Apparatus Manufacturers’ Association (FAMA) member companies are not immune to these negative economic effects, which affect supplies ranging from complete chassis to aluminum, stainless steel, and polymer-based tanks to the thousands of other components that make up a fire truck.

Figure 2. Five-Year Aluminum Spot

At the end of November 2021, the Federal Trade Commission (FTC) announced in a news release that it was going to conduct an inquiry among nine large retailers, wholesalers, and consumer goods suppliers to try to determine the causes for empty shelves and inflated prices at stores across the country. FTC Chairperson Lina M. Khan stated in the release: ‘Supply chain disruptions are upending the provision and delivery of a wide array of goods, ranging from computer chips and medicines to meat and lumber.’ 2

Other Components of Public Service Also Affected

The problems of the global supply chain have extended to other aspects of the fire service and public service as well. As early as April 2020, Miami-Dade (FL) fire officials were forced to acquire face masks in smaller shipments. The federal government had confiscated a shipment of one million face masks to the department, according to the Tampa Bay Times.3 Other media sources reported that the federal government had confiscated shipments of masks to other municipalities as well. The rationale for the confiscations, according to The Federal Emergency Management Agency (FEMA) was that ‘bringing too much personal protective equipment into coronavirus hotspots could have the “unintended sequence” of disrupting supply chain deliveries.’3

In Hancock County, Indiana, Chief Brandon Kleine, Sugar Creek Township Fire Department, noted difficulties his department was experiencing with the procurement of EMS and paramedic supplies. He especially noted ‘the increasing price of everything.’ He cited calls from vendors advising that they ‘were suspecting that they would have an increase of anywhere from 3% to 8%.’4

The Greenfield (IN) Police Department had ordered new squad cars in March 2021. Three, he said, had just arrived. The fourth one was expected to be delivered in early 2022. Deputy Chief Chuck McMichael noted that this wait was ‘a lot longer’ than the usual wait, which generally was from ‘six to maybe 10 weeks.’ He explained that his department was ‘spending a lot of money fixing cars that normally wouldn’t still be in our fleet.’4

Disrupted Areas Directly Affecting the Fire Industry

Disruptions in the following areas have more directly affected the fire industry.

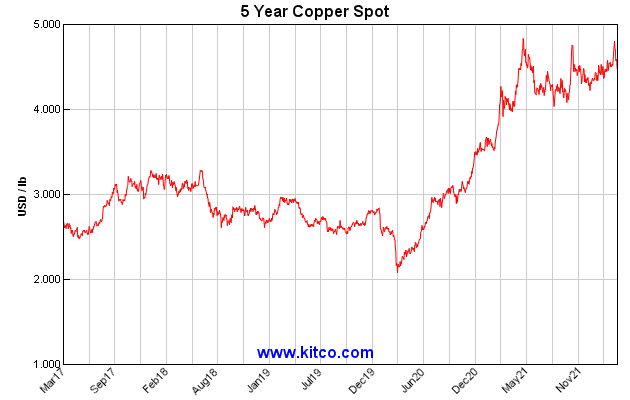

- Rare earth elements. Demand for rare earth elements—among them copper, lithium, nickel, and cobalt–is soaring. As countries switch to green energy, demand for these elements is increasing. They are all vulnerable to price volatility and shortages. Also, there is limited access to known mineral deposits. The Democratic Republic of Congo, China, and Australia, together, control more than 75% of the global output of lithium, cobalt, and rare earth elements.5

Figure 3. Five Year Copper Spot

Disrupted Areas Directly Affecting the Fire Industry (Cont.)

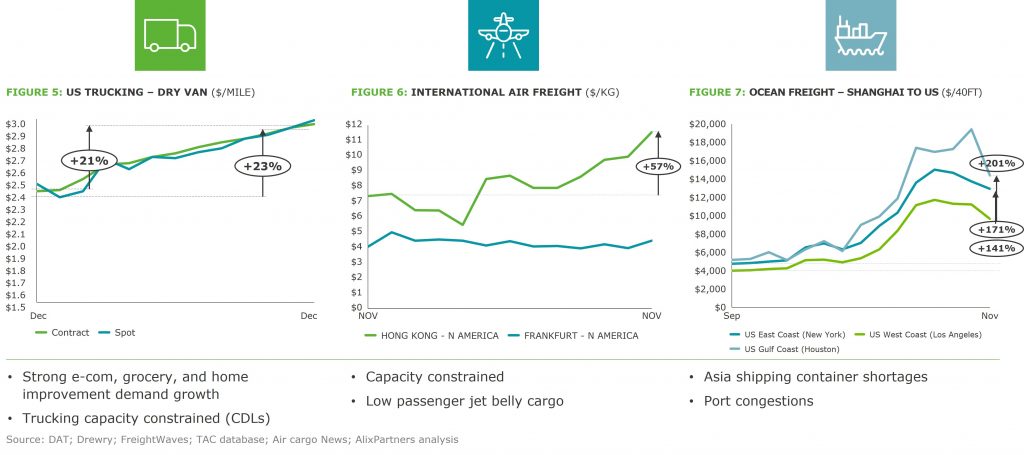

- Freight. Freight costs have increased substantially across domestic trucking; international air freight; and, particularly, international ocean freight. “A mismatch of container and ship locations and a throttling down of port throughput means freight bottlenecks will continue to plague supply chains.”7

- Containers. In September 2021, Tom Quimby, senior editor of Commercial Carrier Journal, reported the following: “As much as a 445% increase in container costs is hitting the supply chain just as ports are dealing with months-long backlogs and suppliers are managing historically high demand. All this adds up to higher prices and continued shortages, with no end in sight …. The situation at ports and at sea threatens to send tidal waves through consumer prices.”6

According to Quimby, an administrator in a major trucking supply company, on the condition of anonymity, revealed the following: ‘The rules in the import game have changed. This means no more COD payments for imported containers (they must be prepaid) and no more guarantees of getting a spot on a freighter.’ This administrator reported also seeing a 445% uptick in import container costs,’ which, he added, ‘will be passed along to customers.’ The forwarder says that the only way to get space on the ship is to prepay, and the price being quoted is about $30,000. About 10-12 months ago, the cost for that same container was about $5,500.6

Figure 4. U.S. Domestic and International Freight Bottlenecks and High Cost

US domestic and international freight bottlenecks and high costs continue to plague supply chains

Global freight rate trends

Source: https://www.fullbay.com/blog/truck-classification/High container costs and constrained supplies pushing up prices on parts | Commercial Carrier Journal (ccjdigital.com)

Disrupted Areas Directly Affecting the Fire Industry (Cont.)

- Steel. The steel industry was caught off guard by the rapid recovery in demand that began last summer, especially in the auto industry. It took time for America’s aging steel mills to resume the production they had sharply cut at the onset of the pandemic. Steel inventories shrank, and shipments were delayed just as steel buyers increased their orders beyond their usual purchases.

- Plastics. Constraints on the supplies of polyethylene (PE), polypropylene (PP), and monoethylene (MEG) are leading to factory shutdowns, sharp price increases, and production delays across a range of industries The plastics made from these chemicals are used in every kind of product imaginable, from food packaging, appliances, smartphones, and car parts to exercise equipment and roller skates.8

During summer 2020, Covid-19-related lockdowns caused inventory levels to fall. Hurricane Laura, in August, forced a number of petrochemical factories in Louisiana and Texas to shut down; overnight 10% to 15% of U.S. PE and PP production stopped.8

Many big polymer producers declared force majeures. (Note: Declaring force majeure relieved these suppliers of certain supply-delivery commitments because of circumstances outside their control.) Simultaneously, Covid-19 safety precautions slowed production at many workplaces and caused labor and trucking shortages at ports.8

As if all this were not enough, a winter storm struck the Gulf Coast in February. Texas is the world’s largest petrochemical complex for turning oil and gas and other byproducts into plastics. It will take more than six months to correct the imbalances caused by the storm. On top of all this, a container ship became grounded in the Suez Canal on March 23.8

Purchasing managers surveyed by the Institute for Supply Management at the end of 2021 anticipated worsening supply-demand imbalances in a variety of areas as the U.S. economy continues to open up. Many companies already face depleted inventories up and down their supply chains, price increases, higher rates of delinquent shipments, and longer lead times for orders. Sourcing experts who are managing suppliers expect disruptions to last for longer than 12 months.8

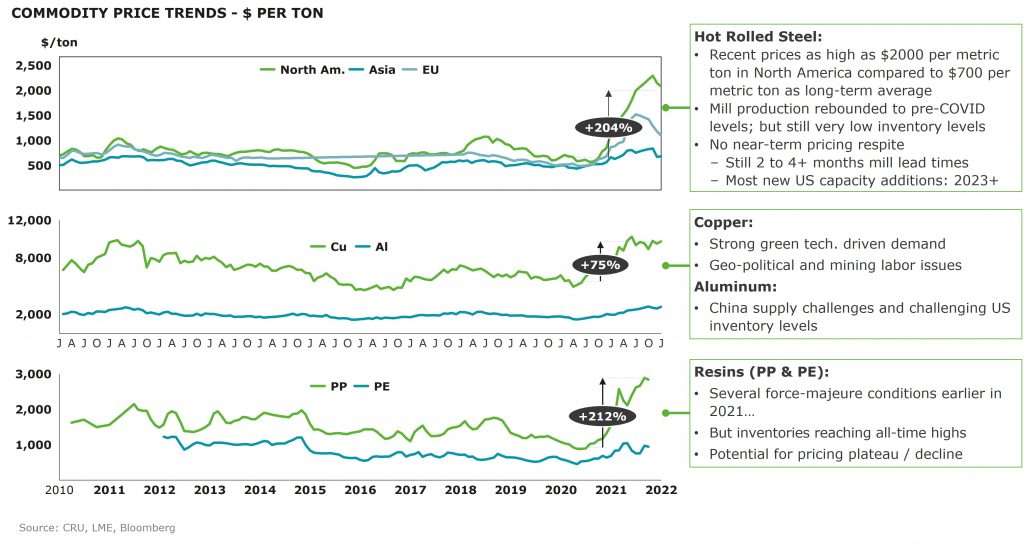

Figure 5. Commodity Price Trends–Cost per Ton

Proactive Moves for Manufacturers and Other Suppliers

“In today’s turbulent environment, companies must rethink certain supply chain fundamentals to maximize revenue and margin,” note Dan Hearsch and Gerrit Reepmeyer of the consulting firm AlixPartners. Among them is “balancing strong demand with massive supply chain disruptions and slim inventories.” In the present marketplace environment, they say: “Cost has taken a back seat to supply security.”5

The uncertainty in the supply chain, according to FTR Transportation Intelligence and ACT Research Co., has caused North American Class 8 net orders to drop about 41% from October and about 82% year-over-year, the lowest for the month of November since 1995. This decrease occurred despite very high demand. It is attributed to the reluctance of original engine manufacturers (OEMs) to increase total backlogs with so much uncertainty about the supply chain.9 ‘Based on October data, the last full month of data available, Kenny Vieth, ACT’s president and senior analyst, noted that the Class 8 backlog was nearly 281,000 units and that at October’s build rate, the backlog-to-build ratio was 14.6 months, illustrating demand versus supply-side challenges.’9

Editor’s Note: Class 8 refers to heavy-duty trucks with a gross vehicle weight rating higher than 33,001. The vehicles in this class include fire trucks, cement trucks, dump trucks.

Examples of Strategies and Plans that some FAMA Member Companies are Starting

FAMA member companies have been diligently working to address the supply challenges in various ways, including the following:

- Establishing multi-functional teams to oversee procurement, finance, scheduling, manufacturing, and sales. This team meets weekly to review the supply chain, check inventory, and to review purchase orders and projected delivery dates.

- Negotiating longer-term orders with release dates.

- Securing additional off-site warehousing space to support companies’ multiple plants with increased inventory levels.

- Maintaining to the greatest extent possible a domestic supply chain, to avoid overseas transportation issues.

- Preserving and building the trust of consumers by bolstering transparency. This entails providing capacity reports to strategic customers on a regular basis and implementing programs that allow for real-time tracking of work in progress (WIP) within our production facilities.

- Searching for alternative methods and fabrication techniques for fire truck components that can be changed without lowering performance and integrity standards–for example, piping parts for internal plumbing.

- Instituting improvements to flow lines that have been overshadowed by material cost and attrition.

- Reaching out to and assisting other suppliers when geographic borders put restrictions on travel—for example, an occasional reciprocal agreement for service because of Canadian- United States travel.

- Imposing surcharges for components whose material cost increases have been significant. This method allows for shorter-term material increases to be reflected as a pass-through without markup.

- Supplementing standard suppliers with nontraditional sources, sometimes securing from customers who stock components (such as fittings) these replacement parts so that a finished product can be delivered. When components are obtained from vendors other than customary suppliers, OEMs sometimes have to modify the acquired component to fit the required size and pipe lengths on the production floor. These decisions are not made arbitrarily; the companies complete whatever research is required, including separate testing before materials other than the usual materials are substituted for the companies’ traditional supply source. Factors involved in these decisions include resins, compound variations, origin source, required certifications, breaking points, capability, and load.

Going Forward

Despite the challenges the global supply system situation has created, FAMA members are confident that manufacturers and consumers can meet them if they work together. They maintain that “Honesty is the best ‘good will’ policy.” To this end, we have invested resources and time in strengthening communications and emphasizing transparency. When orders are placed, consumers are informed of the prevailing lead times. However, consumers are also reminded that customized orders can provide only an educated estimate; many challenges can arise in the months preceding the delivery of their apparatus.

Fire departments anticipating the need for new apparatus should place their order as soon as possible, and not “wait until conditions improve.” Indications from business and managerial experts are that the supply disruptions will be long term. Placing your order will get you on a waiting list and in line for fulfillment of your order. For additional information, contact your FAMA member manufacturer/supplier.

References

- What is supply chain? A definitive guide. (supplychaindigital.com) Supply Chain Magazine is the ‘Digital Community’ for the global Procurement, Supply Chain, and Logistics industry.

- “FTC launches inquiry into supply chain problems,” Mark Schremmer, Nov. 30, 2021; https://landline.media/ftc-launches-inquiry-into-supply-chain-problems/

- Federal Agents Confiscate Masks Meant for Miami-Dade (FL) Firefighters Engineering/ April 23, 2020.

- “Fire, police departments struggling to get vital equipment because of supply chain issues,” Max Lewis, Nov. 11, 2021; Fire, police departments struggling to get vital equipment because of supply chain issues (fox59.com)

- “ Supply chain interrupted: Here’s everything you can’t get now,” Jordan Valinsky, CNN Digital Expansion, May 9, 2021; Shortages are popping up across the supply chain as the pandemic messes with the economy – CNN

- “Container cost surge of 445% collides with constrained supply chain,” Tom Quimby, senior editor, Commercial Carrier Journal, Sept. 18, 2021; High container costs and constrained supplies pushing up prices on parts | Commercial Carrier Journal (ccjdigital.com)

- “Managing Supply Chain Turbulence,” Nov 2021; https://www.alixpartners.com/about-alixpartners/ AlixPartners is an American consulting firm headquartered in New York, NY, best known for its work in the turnaround space.

- Bindiya Vakil, CEO Resilinc, Harvard Business Review; The Latest Supply Chain Disruption: Plastics (hbr.org)/ March 26, 2021. Vakil is a founding member of the Global Supply Chain Resiliency Council and a member of the Advisory Board of the MIT Center for Transportation and Logistics.

- “Class 8 Orders Drop Due to Supply Chain Uncertainly [sic],” Heavy Duty Trucking Staff, Dec. 6, 2021; https://www.truckinginfo.com/10157344/class-8-orders-drop-due-to-supply-chain-uncertainly