It is no secret that lead times for fire apparatus are currently at levels the fire service has rarely seen. There was a time that when an order was placed, a department could expect its new rig to arrive in 12 to 18 months. In recent years, that has changed, but there is no one event that can be considered the root cause. Rather, the delays currently experienced across the industry are, in general, the cumulative result of several factors.

MULTIPLE DRIVERS

The Fire Apparatus Manufacturers’ Association (FAMA) collects high-level, anonymized data available exclusively to members that provide insights into historical trends. FAMA’s Board approved the specific release of annual data to help demonstrate the magnitude of recent industry trends.

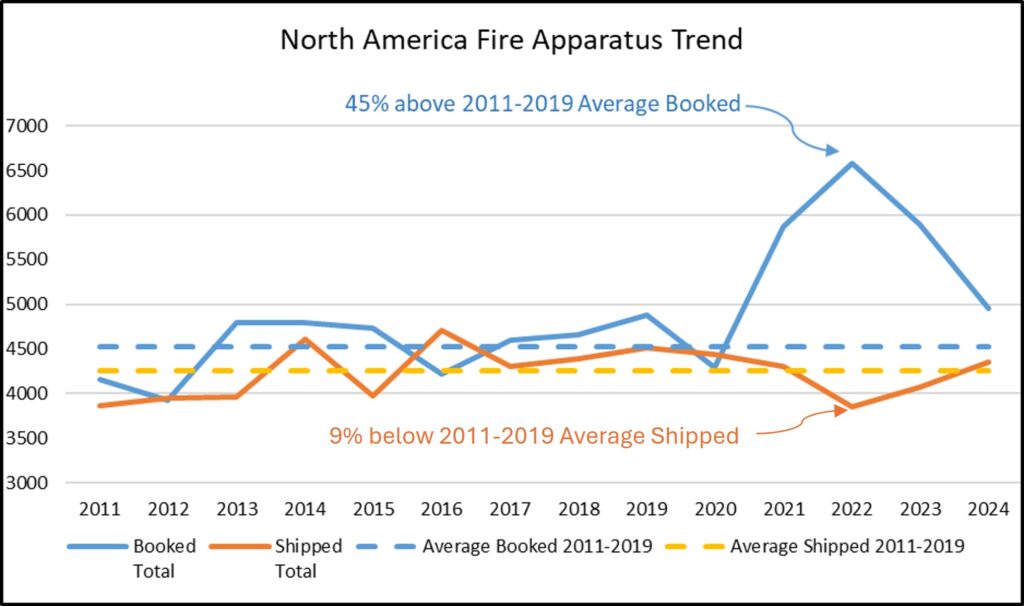

Graph 1, based on FAMA data, contrasts the relatively consistent prepandemic pattern of fire apparatus orders booked and shipped from 2011 to 2019. The average baselines for this period are shown as dotted lines across the width of the graph.

The lead times for custom fire apparatus are already generally longer than other commercial vehicle manufacturing industries because of custom engineering, lower volume, and high-variability manufacturing processes. Many fire apparatus are customized to meet the specific needs of the communities they will serve. The already longer lead times are magnified when booked orders surge over a short period of time and exceed the industry capacity, which is what started to occur after the pandemic.

In 2022, demand increased to exceed the typical supply by 45% while production fell by 9%—because of labor and supply chain disruptions that resulted from the COVID-19 Pandemic. Apparatus purchasing committees and fire apparatus manufacturer representatives could not travel for in-person meetings as the pandemic began, which resulted in delays in research, spec writing, and associated approvals—although these circumstances improved as virtual technologies like Zoom helped connect OEMs and their customers during the pandemic. On top of this, stimulus funding became available, and many municipalities allocated some of those funds to help update aging apparatus fleets—updates that were curtailed during the pandemic—which exacerbated the already higher levels of incoming orders and created a sharp surge in demand.

As meeting and travel restrictions relaxed, many municipalities recognized that lead times were increasing and accelerated their ordering cycles to ensure future availability. This understandable response added to the surge in booked orders and compounded the already challenging lead time concerns.

Graph 1 shows that from 2022 forward, the past 12 to 18 months of booked and shipped orders are moving toward more typical levels.

WHAT ABOUT THE SUPPLY CHAIN?

The supply chain disruptions that occurred as the world emerged from the COVID-19 Pandemic are well-documented. Fire apparatus comprise numerous components, typically numbering in the thousands, many of which are critical to production schedules. Even a minor disruption can impact delivery schedules.

Manufacturers source many of the components used in fire apparatus domestically. However, labor availability, transportation arrangements, and other factors can still adversely impact delivery schedules.

Supply chains have largely recovered from the past several years’ disruptions. Although the industry has implemented a range of steps to handle supply interruptions, typical of any market, a combination of factors could arise and cause further disruptions. Many FAMA members have implemented a number of steps to address supply chain challenges, including developing secondary suppliers—especially for critical components—and carrying additional inventory to bridge potential interruptions where necessary.

Still, the recent introduction of tariffs could disrupt supply chains. At present, it appears that the impact is largely around costing, but it is possible that ongoing tariffs will affect key raw material availability, including aluminum.

LEAD TIME REALITIES

Current lead times are difficult for customers and manufacturers. Once customers have made a commitment, and funds have been allocated, fire departments understandably want to take delivery of their fire apparatus as soon as possible. Manufacturers, likewise, want to deliver a truck in a time frame that makes customers happy.

Currently, FAMA data suggest that the industry is moving toward more normal lead times. Booked orders are trending toward the historical average, and shipped orders have now recovered above the historical average. At the same time, manufacturers have identified capacity improvements that include plant expansions, new manufacturing equipment, and streamlined processes—with many manufacturers taking action on these improvements.

FAMA members that have implemented these improvements report that the investments are beginning to yield results. That said, plant expansions, new equipment, and new processes take time to implement—often several years. If disruptive influences do not return, FAMA data suggest that these initiatives are yielding results, and lead times will continue to normalize over the next twenty-four months.

THE REALITY OF CHOICE

No fire apparatus manufacturer was left untouched by these conditions. FAMA has approximately 135 member companies that manufacture fire apparatus or components for them with production facilities in the United States and Canada. Approximately 55 of those 135 members manufacture fire apparatus. The majority of these members are smaller companies, many of which are family-owned and -operated.

FAMA has the most comprehensive data set in the industry. These data are collected anonymously; however, they point to trends that broadly affect the entire industry regardless of whether a member company is a small, private, or family-owned operation or a larger publicly traded or private equity entity. The data show that no single fire apparatus manufacturer, or group of manufacturers under common ownership, dominates the industry. With 55 fire apparatus manufacturers within FAMA, there is significant choice available to the entire fire service community.

Although FAMA cannot comment on individual members’ operations, general market dynamics suggest that member companies strive to differentiate themselves to both attract and retain customers. Currently, this includes—to the extent possible—using a variety of strategies to reduce costs and lead times.

FAMA is a nonprofit trade association dedicated to improving the quality of the fire apparatus industry and emergency services community. FAMA members manufacture and sell safe, efficient fire apparatus and equipment.

For more information, including a member list and industry news, visit the FAMA website at www.fama.org or email info@fama.org.

About FAMA:

The Fire Apparatus Manufacturers’ Association (FAMA) is a non-profit trade association organized in 1946. Members of FAMA are committed to enhancing the quality of the fire apparatus industry and emergency service community through the manufacture and sale of safe, efficient fire apparatus and equipment.

The Mission of FAMA:

FAMA advances the knowledge, safety, growth, and health of the emergency vehicle market.

The Vision of FAMA:

FAMA is recognized as the most comprehensive resource to the North American emergency vehicle industry.